Mortgage Insurance vs. Homeowners Insurance - Which one is better for you?

Buying a house feels like a walk in a park if you have the right amount of financing to support your decision and an expert guiding you through.

Buying a house feels like a walk in a park if you have the right amount of financing to support your decision and an expert guiding you through. However, not everybody goes around fact-checking things multiple times, and the process can become complicated.

One of the first few things that strike a first-time buyer is usually the documents your lender will ask from you. So if you’re buying a home, your mortgage lender may ask you to show mortgage insurance and homeowners insurance.

While both terms sound similar, these two insurance policies are vastly different. Therefore, it is crucial to understand the distinction between the two.

Mortgage Insurance vs. Homeowners Insurance

Both types of insurance policies provide protection. However, they both are responsible for protecting different things. While you may think one might suffice, there may be instances where you require one or both at the same time. So let’s have a look at each specifically before we jump into key differences.

Mortgage Insurance

Mortgage insurance is more commonly known as PMI that stands for Private Mortgage Insurance. The mortgage lender requires the borrower to acquire PMI in order to protect their interest should the borrower default on their loan. That’s why PMI isn’t what you are looking for to protect the home or yourself as the homebuyer. Instead, PMI is there to protect the mortgage lender should you default on your loan.

Homeowners Insurance

Homeowners insurance or simply home insurance is the regulated insurance coverage and a mandated requirement by all mortgage lenders for all the borrowers. In comparison to PMI, the requirement of buying homeowners insurance has nothing to do with the down payment that you are making on your home. In fact, homeowners insurance is related to the value of the home and property to ensure the security of your investment in it.

Mortgage Insurance vs. Homeowners Insurance – Key Differences

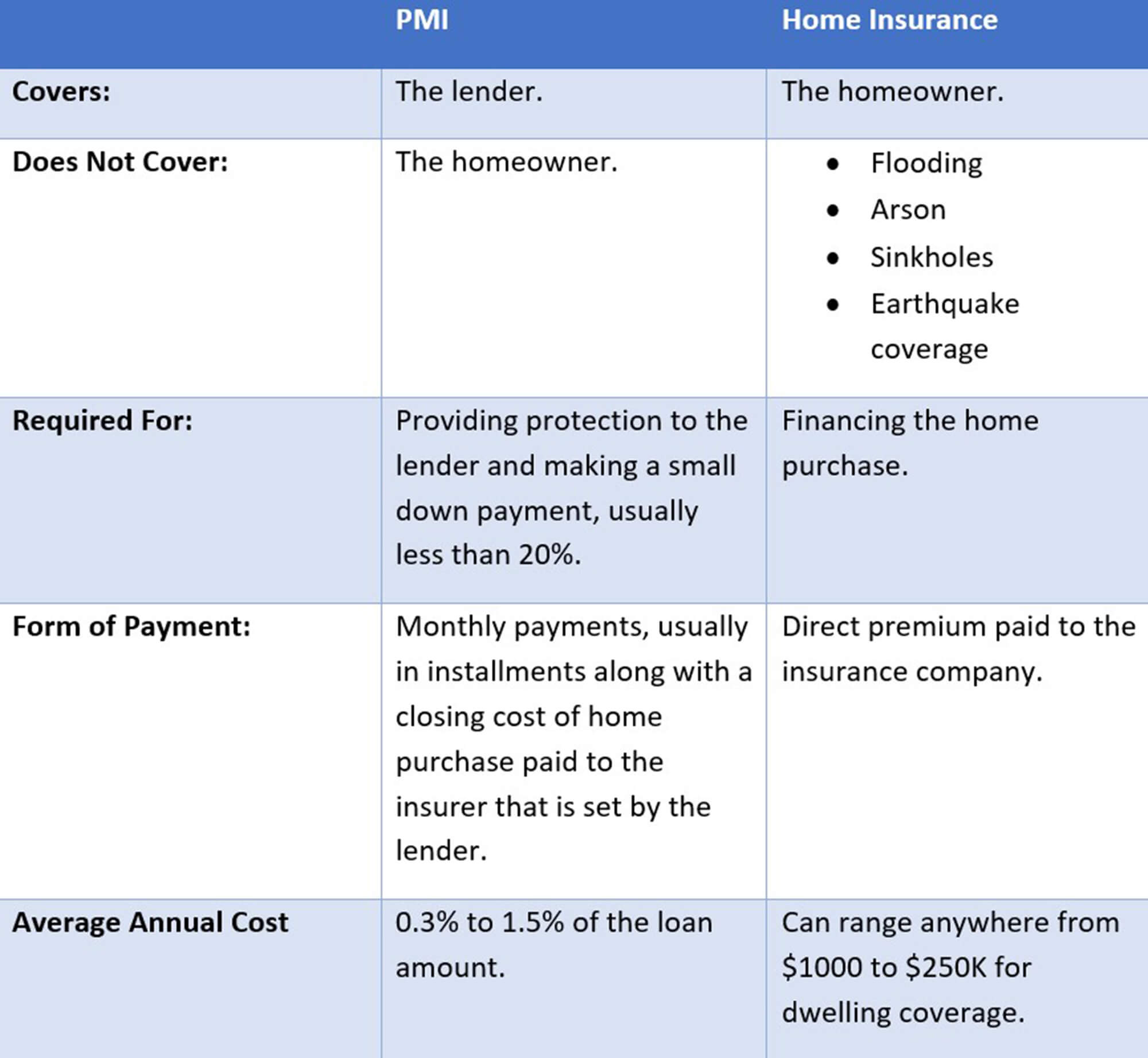

Now that you know both what these two insurance types cover, the following are the key differences that can be essential in identifying which one of the two is your requirement in the current home buying situation.

Bottom Line

Even though private mortgage insurance and homeowners insurance are directly or indirectly related to protecting your property, investment, and the lender, homeowners insurance is mainly what works for your benefit. Therefore, knowing when to utilize which of the two is essential to spread out your financial risks if you suffer a significant loss.

However, there is no simple formula to determine the type of mortgage that is best for you. This choice depends on several factors, including your current financial situation and how long you intend to keep your house. Northwest Mortgage Inc. can undoubtedly help you evaluate your choices and help you make the most appropriate decision.

To get started, give us a call at +1 260-471-3434 today!